Santa Fe County Gross Receipts Tax Rate 2024. Gross receipts location code and tax rate map. The gross receipts tax rate varies throughout the state from 5.125% to 8.6875% depending on the location of the business.

The local sales tax rate in santa fe county is 2%, and the maximum rate (including new mexico and city sales taxes) is 8.8125% as of april 2024. The 8.1875% sales tax rate in santa fe consists of 4.875% new mexico state sales tax and 3.3125% santa fe tax.

Identify The Appropriate Grt Location Code And Tax Rate By Clicking On The Map At The Location Of Interest.

The 8.1875% sales tax rate in santa fe consists of 4.875% new mexico state sales tax and 3.3125% santa fe tax.

Tax Rates Are Provided By.

The state gross receipts tax rate.

What Is The Sales Tax Rate In Santa Fe County?

Images References :

Source: www.thetechedvocate.org

Source: www.thetechedvocate.org

How to calculate gross receipts The Tech Edvocate, Identify grt location codes and rates quickly. State law determines the state's portion of the gross receipts tax, which changes annually, typically in july.

Source: www.pdffiller.com

Source: www.pdffiller.com

2021 Form TN Gross Receipts Tax Return City of Gatlinburg Fill Online, The 8.1875% sales tax rate in santa fe consists of 4.875% new mexico state sales tax and 3.3125% santa fe tax. County commissioners and municipal councils govern local portions,.

Source: blog.usgeocoder.com

Source: blog.usgeocoder.com

2024 New Mexico Sales Tax (Gross Receipts Tax) Rate Changes, The state gross receipts tax rate. New mexico property tax rate districts, special districts, and school districts.

Source: www.youtube.com

Source: www.youtube.com

September 19th Morning Rush Polls open for Santa Fe County gross, County commissioners and municipal councils govern local portions,. Look up 2024 sales tax rates for santa fe, new mexico, and surrounding areas.

Source: fill.io

Source: fill.io

Fill Free fillable Form 2021. PROPERTY TAXES 2021 SANTA FE COUNTY, The local sales tax rate in santa fe county is 2%, and the maximum rate (including new mexico and city sales taxes) is 8.8125% as of april 2024. Identify the appropriate grt location code and tax rate by clicking on the map at the location of interest.

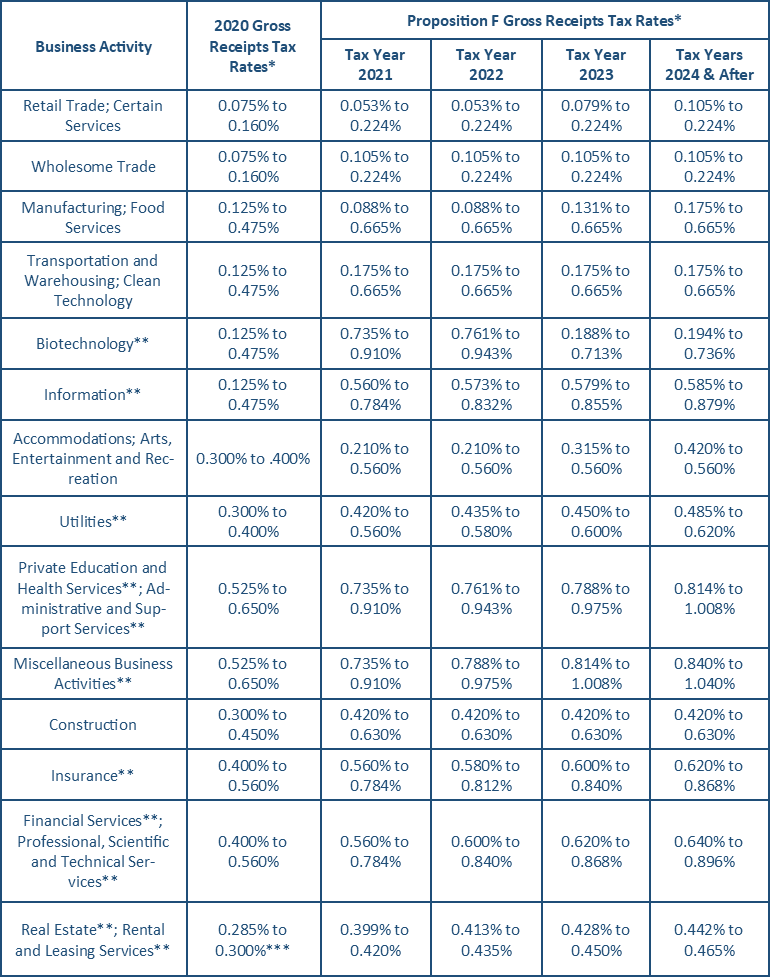

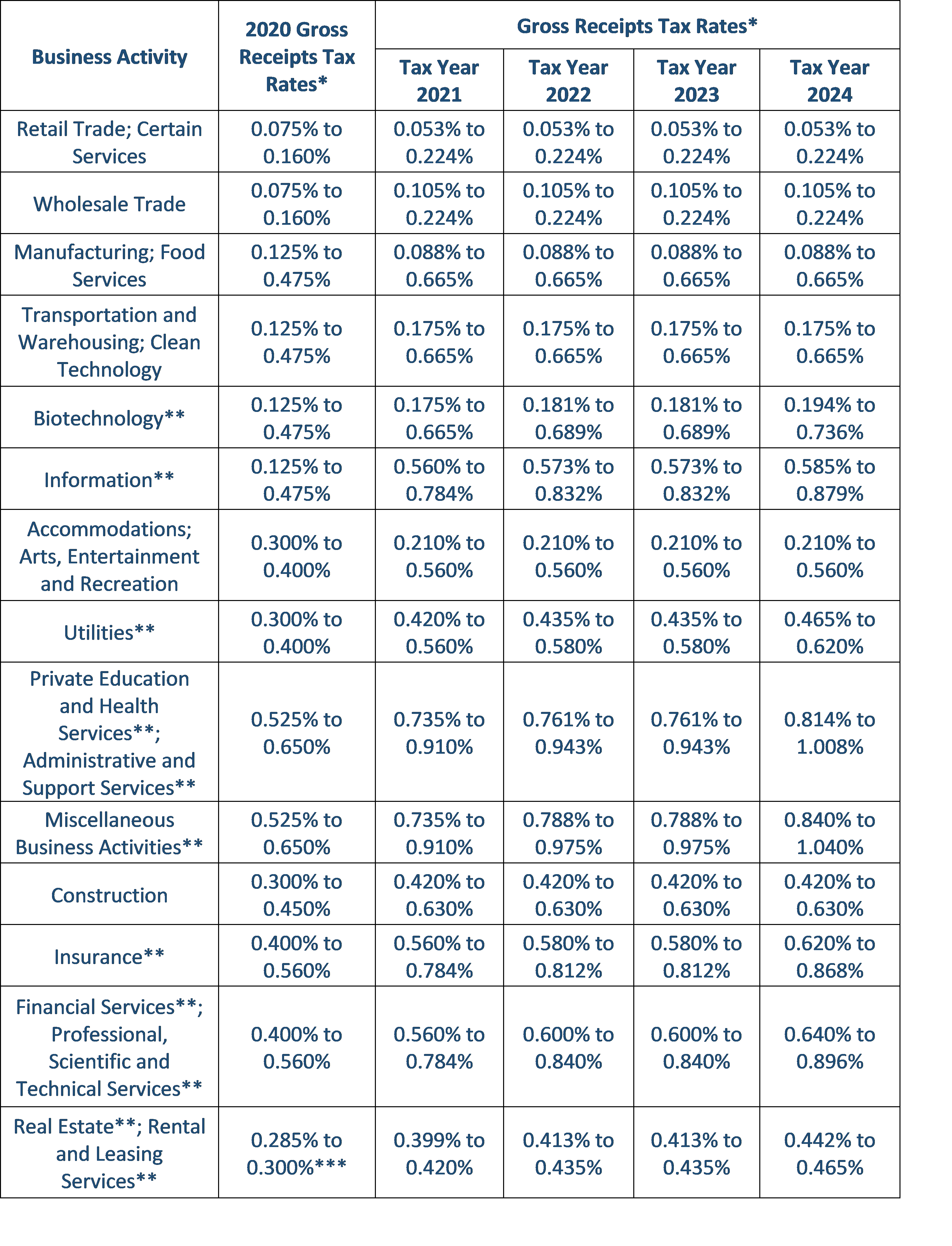

Source: sftreasurer.org

Source: sftreasurer.org

Gross Receipts Tax (GR) Treasurer & Tax Collector, The local sales tax rate in santa fe county is 2%, and the maximum rate (including new mexico and city sales taxes) is 8.8125% as of april 2024. The 2024 tax rates and thresholds for both the new mexico state tax tables and federal tax tables are comprehensively integrated into the new mexico tax calculator for 2024.

Source: sftreasurer.org

Source: sftreasurer.org

Gross Receipts Tax (GR) Treasurer & Tax Collector, Identify the appropriate grt location code and tax rate by clicking on the map at the location of interest. The local sales tax rate in santa fe county is 2%, and the maximum rate (including new mexico and city sales taxes) is 8.8125% as of april 2024.

Source: www.pngegg.com

Source: www.pngegg.com

Tax rate Definition Sales tax, Gross Receipts Tax, angle, text png PNGEgg, Michelle lujan grisham unveiled bipartisan legislation thursday that would lower the state’s gross receipts tax rate an additional quarter. Identify grt location codes and rates quickly.

Source: www.santafenewmexican.com

Source: www.santafenewmexican.com

County commissioners approve increase in gross receipts tax Local, It varies because the total rate combines rates imposed by the state, counties, and, if applicable,. Look up 2024 sales tax rates for santa fe, new mexico, and surrounding areas.

Source: www.hiclipart.com

Source: www.hiclipart.com

Josephine County Jackson County, Oregon Linn County Curry County, The minimum combined 2024 sales tax rate for santa fe county, new mexico is. Santa fe resident diana howell, who was rescued by paramedics while hiking in the mountains in march, speaks in support of the gross receipts tax increase.

What Is The Sales Tax Rate In Santa Fe County?

The grt in santa fe has dropped in the past two years from 8.3125% to 8.1875% on saturday.

New Mexico Property Tax Rate Districts, Special Districts, And School Districts.

The 2024 tax rates and thresholds for both the new mexico state tax tables and federal tax tables are comprehensively integrated into the new mexico tax calculator for 2024.