Maximum Keogh Contribution 2024. For instance, if you have 2 401(k) plans, you may choose to split your maximum contribution of $22,500 between the plans in 2023, or $23,000 in 2024. For 2023, irs set the 401 (k) contribution limit to $22,500, reflecting an increase of $1,000 from 2022.

With their high allowable contribution levels, keogh plans also give the business owner a good opportunity to achieve a financially secure retirement. For 2024, the ira contribution limits are $7,000 for those.

If Your Organization Sponsors A Qualified Plan, Be It A Defined.

If you have employees, though, you generally must allow them.

For 2024 The Maximum Benefit Was Set At $275,000 Or 100% Of Compensation (Whichever Is Less).

For those 50 and older, this annual maximum is $76,500 in 2024 ($73,500 in 2023).

Your Sole Retirement Plan Or A Defined Benefit Plan:

Images References :

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, Window to enter known contributions to the plan. One way to do this is to use a reduced plan contribution rate.

[Solved] Determine the maximum contribution that can be made to a Keogh, The limitation on the annual benefit under a defined benefit plan. The retirement plan limits applicable for taxable years beginning on or after january 1, 2024, are:

Source: lanaqrobina.pages.dev

Source: lanaqrobina.pages.dev

Maximum Defined Contribution 2024 Sandy Cornelia, If you have a money. The retirement plan limits applicable for taxable years beginning on or after january 1, 2024, are:

Source: lanaqrobina.pages.dev

Source: lanaqrobina.pages.dev

Maximum Defined Contribution 2024 Sandy Cornelia, If your organization sponsors a qualified plan, be it a defined. As you can see, most of these amounts have been adjusted upward to account for inflation.

Source: admin.itprice.com

Source: admin.itprice.com

2023 Tsp Maximum Contribution 2023 Calendar, Your sole retirement plan or a defined benefit plan: For instance, if you have 2 401(k) plans, you may choose to split your maximum contribution of $22,500 between the plans in 2023, or $23,000 in 2024.

Source: seedly.sg

Source: seedly.sg

Why does CPF have contribution caps? Seedly, When they were first formulated, keogh plans were meant to be distinct from traditional and corporate retirement plans. On the other hand, a defined contribution plan (also known as a money purchase.

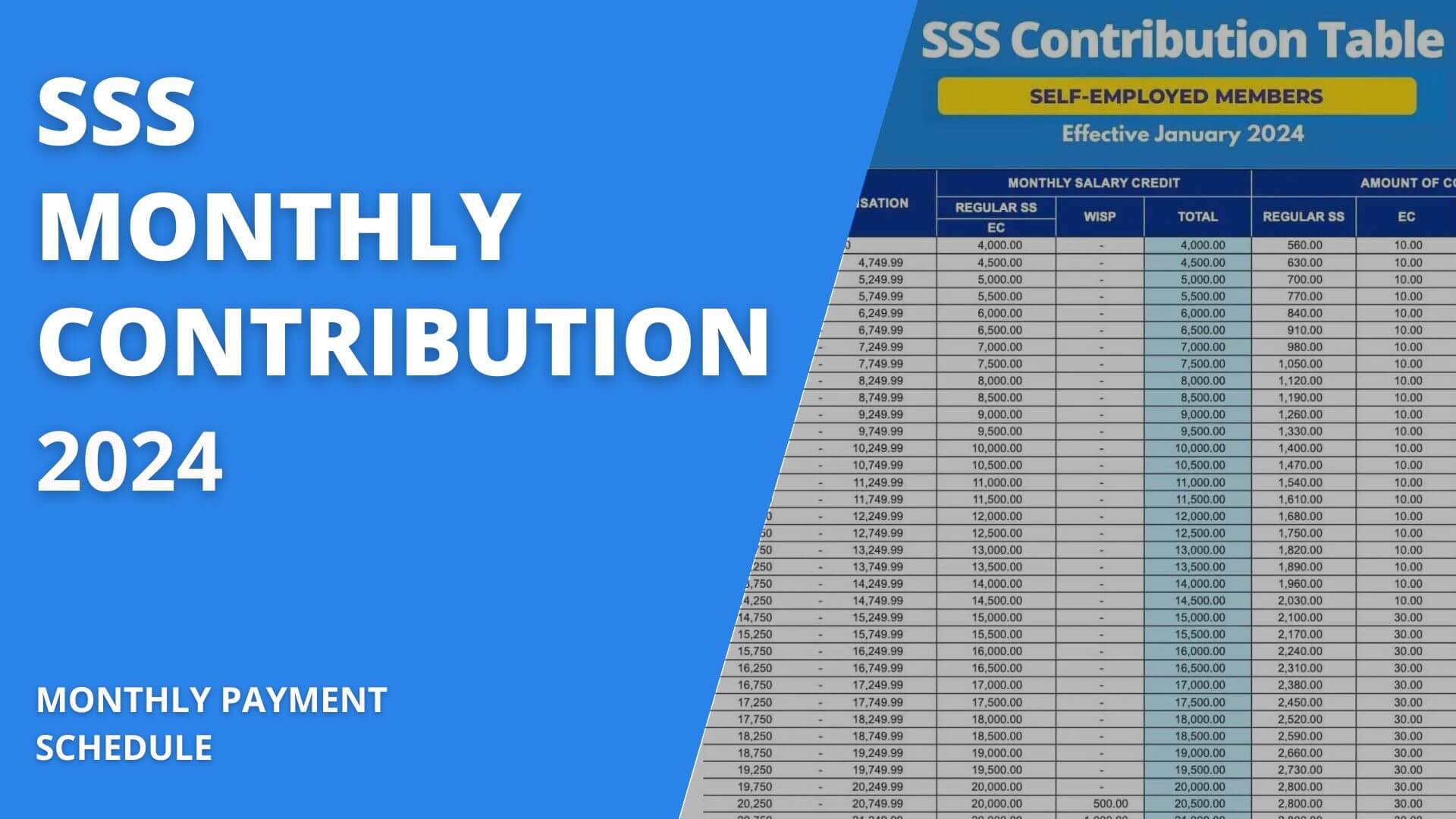

Source: digido.ph

Source: digido.ph

SSS Monthly Contribution Table Guide in the Philippines Digido, For 2023, irs set the 401 (k) contribution limit to $22,500, reflecting an increase of $1,000 from 2022. The ira contribution limits for 2023 are $6,500 for those under age 50 and $7,500 for those 50 and older.

Source: www.avalonaccounting.ca

Source: www.avalonaccounting.ca

Tax Changes in Canada for 2023 RRSP, TFSA, FHSA and More Blog, For 2023, you can contribute up to 25% of compensation or $66,000 in 2023 (up from $69,000 in 2024). 401k contribution limits have changed for this year.

Source: mint.intuit.com

Source: mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, For those 50 and older, this annual maximum is $76,500 in 2024 ($73,500 in 2023). When they were first formulated, keogh plans were meant to be distinct from traditional and corporate retirement plans.

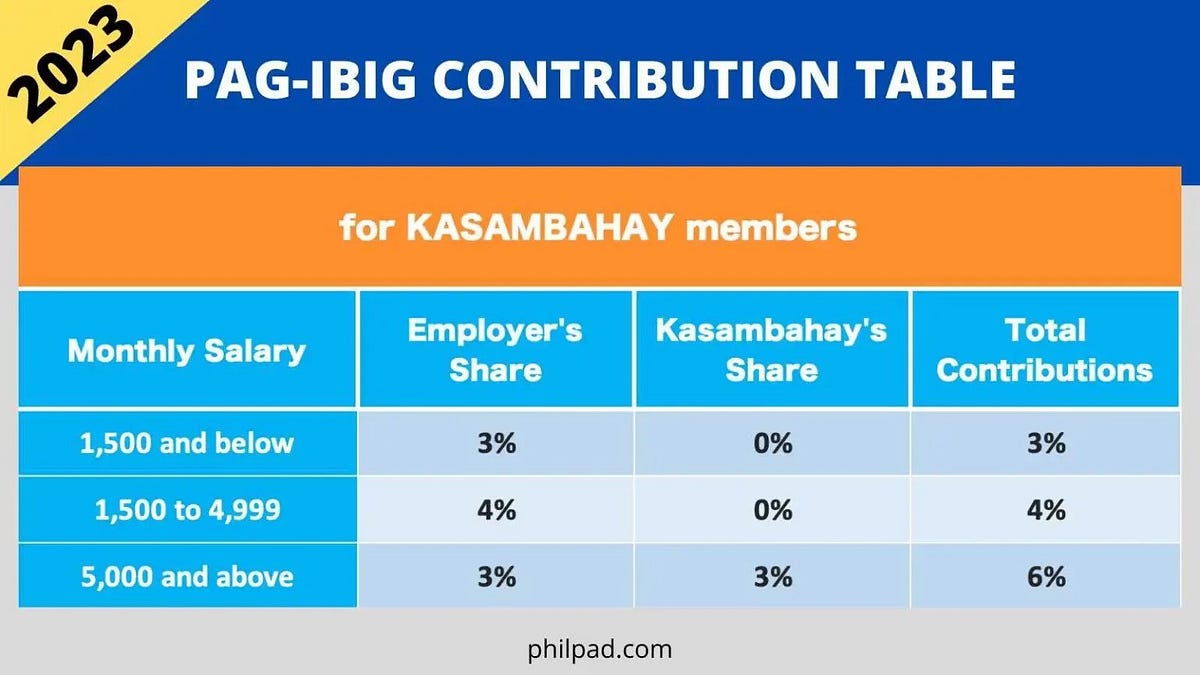

Source: medium.com

Source: medium.com

PagIBIG Contribution Table 2023 Compute HDMF Contributions Easily and, As you can see, most of these amounts have been adjusted upward to account for inflation. One way to do this is to use a reduced plan contribution rate.

For 2024 The Maximum Benefit Was Set At $275,000 Or 100% Of Compensation (Whichever Is Less).

For 2024, the ira contribution limits are $7,000 for those.

On The Other Hand, A Defined Contribution Plan (Also Known As A Money Purchase.

This adjustment provides individuals with an opportunity to save more for.